Summary:

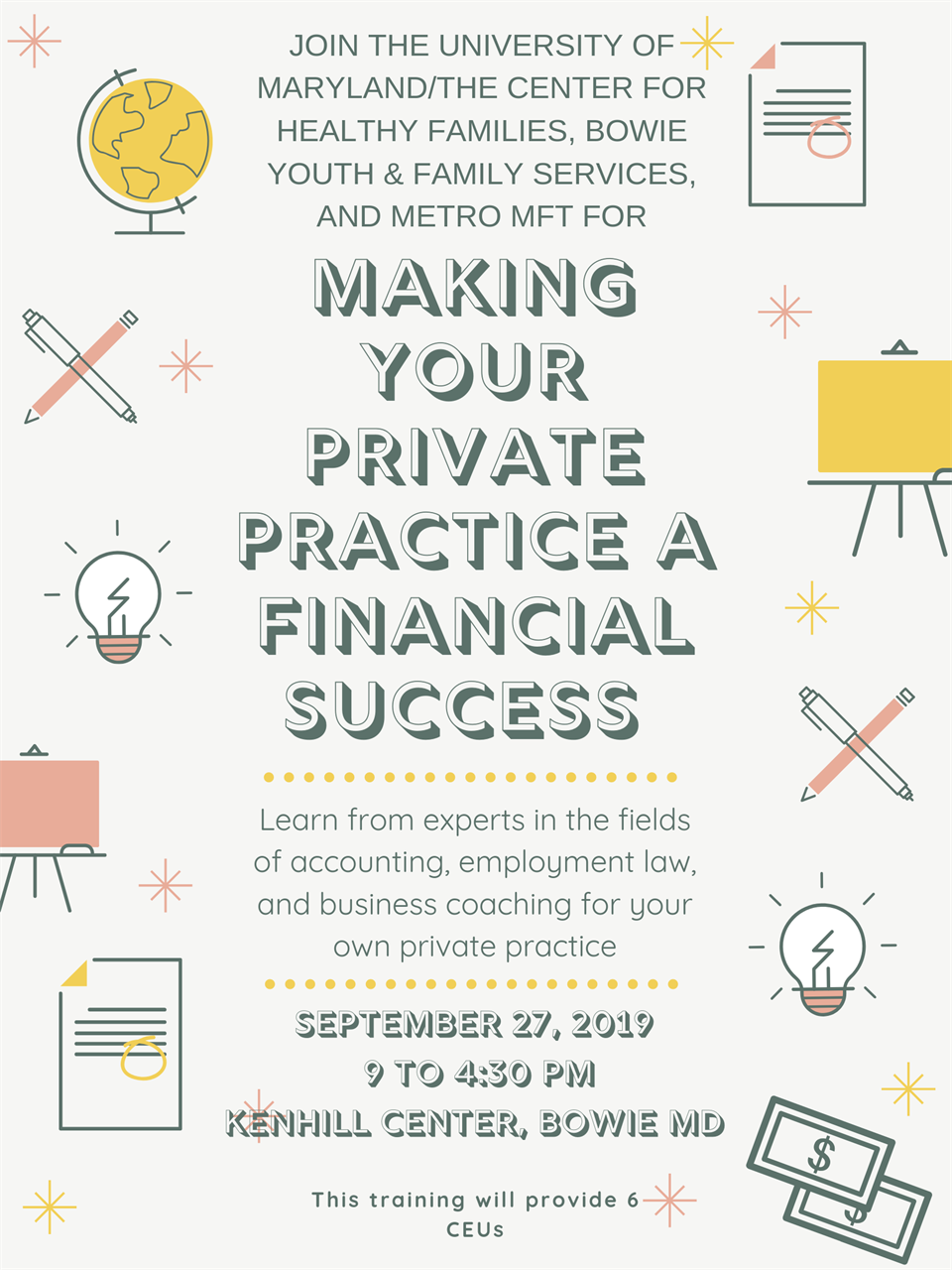

Many of us feel uncomfortable around the financial and business aspects of running a successful private practice. Uncertainty around the best way to set up the practice as a business entity, how to (legally) minimize taxes owed, how to set rates, etc. make many of us anxious. To help with all this, Metro MFT is offering a professional development training for Marriage and Family Therapists, Counselors, and Social Workers to learn about the tools necessary for a financially successful private practice. Whether you have your own practice or have been thinking about opening one, and want to learn how to make more and lower your taxes, this is the training for you!

In this 6-CEU training, participants will learn from four presenters in three distinct fields: Accounting, Employment Law, and Financial Strategy. The presenters will cover a broad range of topics in one training, designed to support you in minimizing money concerns, so you can concentrate on your main mission – providing the best possible therapy services to your clients!

Objectives:

Participants completing this course will be able to...

· Identify considerations for setting session rates correctly and calculate minimum session rate based on hypothetical business budget and personal situation, allowing their practice to thrive without burnout.

· Identify the pros and cons of possible ways to pay themselves from their practice depending on their business entity type, and choose the way that optimizes their personal and business cashflow.

· Identify basic employment law principles especially as applies to small businesses, making them more aware of important issues when consulting with an employment-law attorney

· List the main criteria determining if associates are classified as employees or independent contractors, allowing them to collect information needed by an employment-law attorney in counseling them.

· Identify who holds the therapist-client privilege, who can waive it, and what to do when receiving a subpoena or court order to disclose therapy notes and records, enabling them to make correct choices.

· Describe various business entity types used for therapy practices, and list the differences between them, helping them understand how a CPA assesses which is best for their practice.

· Identify ways to structure a business and retirement plan to minimize taxes, including the 20% Qualified Business Deduction, and list the factors that affect to what extent it applies to their practice revenue, so they can understand their accountant’s recommendations and the implications of these choices.

· Calculate an optimal amount to pay themselves and an optimal amount to set aside for taxes based on practice revenue, so they don’t face large tax bills or penalties.

· Identify the correct way of responding when receiving a letter from the IRS, so they can partner with their accountant if and when this happens.

· List typical pitfalls when setting up accounting and payroll for a new practice, so they understand why their accountant makes certain recommendations, and the implications of not following such advice.

· Identify business and tax professionals well-versed in the needs of private practices, allowing owners to reduce time and effort spent on business finances, freeing them to provide therapy services to clients

To join Metro MFT, click here.